Contents:

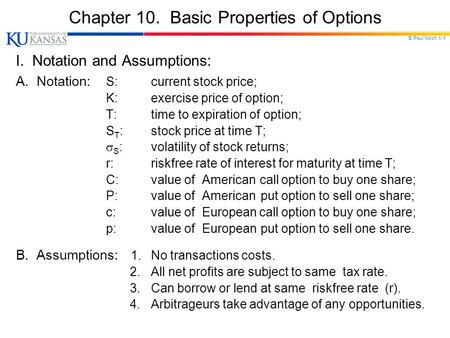

To calculate the cash flow break-even point for a product, you need to know the contribution margin, the fixed costs, and the sales volume. The contribution margin is the difference between the selling price and the variable costs. The fixed costs are the costs that don’t change with the level of production.

Marshall graduated from Appalachian State University with a Bachelor’s degree in Finance. He holds a Series 65 license and is a Chartered Financial Analyst level 2 candidate. A bank overdraft is a credit agreement with a bank to let the account holder withdraw more money than they have up to a limit. Future financial predictions help your company to make key decisions such as whether to hire more staff, open a new branch, or expand to a new market. The beginning cash and ending cash in Table 1 is the amount of cash a company has at the beginning and the end of each month.

A break-even analysis is an essential element of financial planning. Here’s how to apply it to your business.

Hit “View Report” to see a detailed look at the profit generated at each sales volume level. Justin helps business owners and accountants learn how to maximize CashFlowTool to understand, manage and forecast cash flow. When you calculate your cash break-even, we are working with forecasted expenses (i.e., those that you are planning for and expect to occur in the future) and you calculate it over a period of time. These include materials and supplies, as well as the purchase of new equipment.

“In the next 3 months, we need to sell $86,000 to cover our expenses.” Because it will help guide you in creating a plan of attack to achieve it. Most importantly, it will help you evaluate options and determine where you should focus your time. Variable Expenses – change based on the amount that you sell (think commissions for salespeople, cost of goods or other materials, etc.). In this article and the video below, we will outline how you can use a cash break-even Analysis to help identify the amount of revenue you need to cover your expenses.

Corporate LearningHelp your employees master essential business concepts, improve effectiveness, and expand leadership capabilities. You can calculate based on one specific collection, multiple price points, or different pieces or collections. This download is a pre-formulated worksheet that allows you to enter in your values and it automatically calculates your Break Even Point for you! After you complete the Break Even section, the last tab in the workbook will bring over these values to aid in figuring your Monthly Cash Flow Projections. Fortune‘s CFO Daily newsletter is the must-read analysis every finance professional needs to get ahead.

Why is a cash flow forecast important?

Because it is very useful if you want to know how much money you spend on marketing, administration issues or even on eating-out or the coffee that you order every morning on your way to work. Excess Cash Flow Payment Period means, with respect to the repayment required on each Excess Cash Flow Payment Date, the immediately preceding fiscal year of the Borrower. Cash Flow mean net income after taxes, and exclusive of extraordinary gains and income, plus depreciation and amortization.

The timing is also usually the same as long as a check is received and deposited in your account at the time of the sale. The purchase of livestock feed is both an expense and a cash outflow item. The timing is also the same if a check is written at the time of purchase.

- In that case, you could use a cash break even analysis to determine how much cash to move out of the business and back to investors through dividends or repurchases.

- The controversial moves have rattled advertisers, who contribute 90 percent of Twitter’s revenue.

- This chart is useful for determining the minimum level of sales needed to cover costs.

- In the example above, assume the value of the entire fixed costs is $20,000.

- If splitting your payment into 2 transactions, a minimum payment of $350 is required for the first transaction.

For the purposes of calculating a cash break-even, make sure to keep in mind that we are focused on cash costs to reach a certain level of revenue in the short-term. The above is a simple illustration of the calculation of cash break-even only, not a demonstration on how to calculate variable cost. To put it into smaller household terms, this is a paycheck or paid invoices versus bills and rent.

Why is the Contribution Margin Important in Break-Even Analysis?

This is actual cash inflows and outflows used in the daily operations. It does not include investing or financing activities, such as a new bank loan or sale of an asset. Benefits of cash flow forecasts include better planning for the future, growth, and more efficient cash surplus management. A cash flow statement gives an overall picture of a company’s financial position. From the statement, you can see how much a company earns per year and whether it has enough cash for future operations. A cash flow statement is only one of several financial statements that can be used to measure the financial strength of a business.

If you are selling services, this number is what it costs you to deliver your services. This might include the costs of paper or other materials you use when you are presenting to a client, or the cost of gas that it takes you to drive to a typical client. The cash flow statement includes non-cash transactions such as depreciation or receivables not yet collected.

What Are the Drawbacks of the Cash Flow Break-Even Point?

Using a cash break even calculator can help you make these calculations more quickly and with a lower risk of errors. 🚀 We just launched Causal for Startups, a new product for early-stage companies! Since each window is $100, that means the company needs to sell 125 windows.

Riverlane Raises $18.7M Series B to Advance Useful Quantum … – HPCwire

Riverlane Raises $18.7M Series B to Advance Useful Quantum ….

Posted: Mon, 24 Apr 2023 15:13:56 GMT [source]

Working with a remote bookkeeping service will still provide you with all the value you could get from an in-office bookkeeper but at a fraction of the cost. Outsourcing your bookkeeping is more affordable than you would think. We save you money the moment you hire us by cutting out the expensive cost of hiring an in-house CFO.

Last but not least, you should ask yourself, “What adjustments can I make to lower the cost of manufacturing or generate the end result I envision? ” For instance, you may be able to source some products from a cheaper distributor, or perhaps make some changes to your hiring process to save on labor costs. We accept payments via credit card, wire transfer, Western Union, and bank loan. Some candidates may qualify for scholarships or financial aid, which will be credited against the Program Fee once eligibility is determined. Please refer to the Payment & Financial Aid page for further information.

A projection of future flows of cash is called a cash flow budget. You can think of a cash flow budget as a projection of the future deposits and withdrawals to your checking account. Returning to the example above, the contribution margin ratio is 40% ($40 contribution margin per item divided by $100 sale price per item). Therefore, the break-even point in sales dollars is $50,000 ($20,000 total fixed costs divided by 40%).

Variable costs are the sum of the labor and material costs it takes to produce one unit of your product. A break-even analysis is a financial calculation used to determine a company’s break-even point . If we add up the fixed and variable expenses for the 3 months, we have $86,000 in total expenses. This is the amount we need to sell to keep a neutral cash position and cover all of our expenses for that period. More concretely, CFBE is the point at which a business is just able to cover its costs with its income. When reaching this state, a company or project is said to have achieved a cash flow break-even point, i.e. is breaking even.

Riverlane secures £15m Series B for quantum operating system – UKTN (UK Technology News

Riverlane secures £15m Series B for quantum operating system.

Posted: Mon, 24 Apr 2023 10:44:20 GMT [source]

Are you interested in gaining a toolkit for making smart financial decisions and the confidence to clearly communicate those decisions to stakeholders? Explore our online finance and accounting courses and discover how you can unlock critical insights into your organization’s performance and potential. To find out which course is best for you, download our free flowchart. Profit and cash flow are just two of the dozens of financial terms, metrics, and ratios that you should be fluent in to make informed business decisions. By gaining a thorough understanding of key financial principles, it’s possible to advance professionally and become a smarter investor or business owner. The key difference between cash flow and profit is while profit indicates the amount of money left over after all expenses have been paid, cash flow indicates the net flow of cash into and out of a business.

It’s much easier to set goals and follow through when you have concrete numbers in mind. A break even analysis can help your business reach its goals, whether that be increased revenue or growth. Using the window company from above, it pays $10,000 per month to rent its warehouse and pay for its equipment. This is the fixed expense, as it does not change regardless of how many windows are manufactured. This will include the direct costs for making the window, such as wood, paint, or glass panes.

By post closing trial balanceing the break-even point, investors can make profitable investment decisions and manage risks effectively. Overall, break-even analysis is a critical tool in the financial world for businesses, stock and option traders, investors, financial analysts and even government agencies. The concept of break-even analysis is concerned with the contribution margin of a product. The contribution margin is the excess between the selling price of the product and the total variable costs. For example, if an item sells for $100, the total fixed costs are $25 per unit, and the total variable costs are $60 per unit, the contribution margin of the product is $40 ($100 – $60).

UK-based Riverlane raises €16.9M to make quantum computing … – Silicon Canals

UK-based Riverlane raises €16.9M to make quantum computing ….

Posted: Mon, 24 Apr 2023 07:53:02 GMT [source]

He is the sole author of all the materials on AccountingCoach.com. “Let’s just sell as much as we can. Having a target won’t change the fact that we are going to try and generate a lot of revenue.” A cash break-even analysis helps you solve for that amount of cash so you know what to target in your own business.